Associate Professor Dr Aishath Muneeza

INCEIF, Malaysia

Zakat as we all know is a very important pillar of Islam and a socio-economic tool for alleviating poverty. The effectiveness of zakat when properly applied has been demonstrated throughout history. For instance, during the period of the Caliph Umar bin Abdul Aziz, it is said that there were no poor in society who wanted to receive zakat because the institution had been that effective in eliminating poverty at that time.

There are eight recipients of zakat derived from the primary source of Islamic law which is the Quran and one of these categories is the poor. “Zakat is for the poor and the needy, and amil (those employed to administer the funds), for the muallaf (those who have embraced Islam), for those in bondage and debt, those who strive in the cause of Allah and for the wayfarer: (thus is it) ordained by Allah and Allah is full of knowledge and wisdom.” (Surah At-Taubah: 60).

Many, in these times, ask whether technology-based innovations can be allowed to facilitate the fulfilment of religious duties or the daily activities of humans. The general answer to this is that technology like any other thing can be used for good or evil. If the technology-based innovation creates good and facilitates human beings to achieve the maqasid al shariah (objectives of the Shariah) including maslahah (public interest) there is no reason why technology-based innovations cannot be utilised to help the poor fulfil their basic needs like satisfying hunger via zakat money.

Blockchain Technology and Zakat

Research is ongoing to integrate blockchain technology into zakat. It is reported that Dr Ziyaad Mahomed, Associate Dean of executive education and e-learning at the International Centre for Education in Islamic Finance (INCEIF), and his team have come up with an Islamic social financing app that leverages blockchain technology. The modus operandi of this app has been summarized by Dr Ziyaad as follows according to the edge markets (2018):

How the app works is very simple. When users turn it on, they are presented with two options: sadaqat (charity) or zakat. If they choose zakat, the app prompts them to select the school of thought they follow — Shafi, Maliki, Hanbali or Hanafi — as there are differences of opinion. Then, the app asks a few questions such as where they would like to see their money go. It gives them a choice of projects such as water irrigation, sanitation, poverty eradication and education. After choosing the project, they complete their payment using a secure gateway. Specific projects are listed. And once the zakat payment has been made, it is registered on a node in the blockchain. Payers will receive confirmation of acceptance. Now, the project has their money. When the money has been fully utilised, the payers will be notified via the app. Thanks to the transparency provided by the blockchain, there is more confidence among payers that their zakat has reached the intended recipients.

This app was developed in partnership with Dublin-based financial technology (fintech) company AidTech and the International Federation of Red Cross and Red Crescent Societies. It was supposed to be launched at the end of last year but has not been launched as of yet. This technology-based innovation promoted transparency in zakat and sadaqah, with the goal of boosting the confidence of contributors.

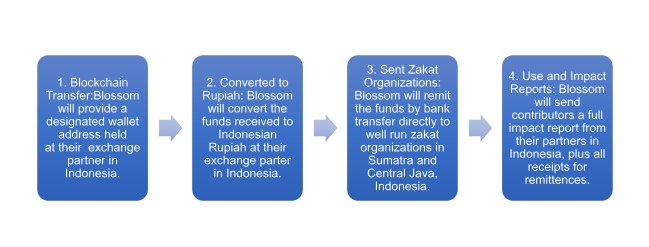

In May 2018, it was reported that Indonesian based Blossom Finance was, in the month of Ramadan, offering a free service allowing Muslims to pay zakat owed against cryptocurrency holdings directly using the blockchain and these payments collected by Blossom would go towards orphans and widows in Sumatra and Central Java, Indonesia via Blossom’s network of cooperatives and nonprofits.

This service by Blossom is offered free of charge and no payment is charged for using the service. According to their website, Blossom will accept payments in cryptocurrency directly via the Blockchain to a Blossom controlled wallet held at a cryptocurrency exchange in Indonesia. Blossom then converts the cryptocurrency to Indonesian Rupiah and deposits the amount into the bank accounts of their cooperative and nonprofit partners located in rural areas in Indonesia. How this works is summarized in the diagram below:

In regard to exchange fees, it was stated that Blossom has consulted with their internal Shariah advisory and they have been advised that exchange fees incurred when converting from cryptocurrency to local currency qualify as part of the total zakat payment.

Bearing this in mind, it is stated that Blossom will try their best to trade the crypto in a way that incurs minimal or no fees. It is essential to note that Blossom Finance has published a working paper on the permissibility of Bitcoin and cryptocurrency and has concluded that Bitcoin qualifies as Islamic money, except where banned by local government, but cautions investors against speculation, initial coin offerings (ICOs) and investment schemes.

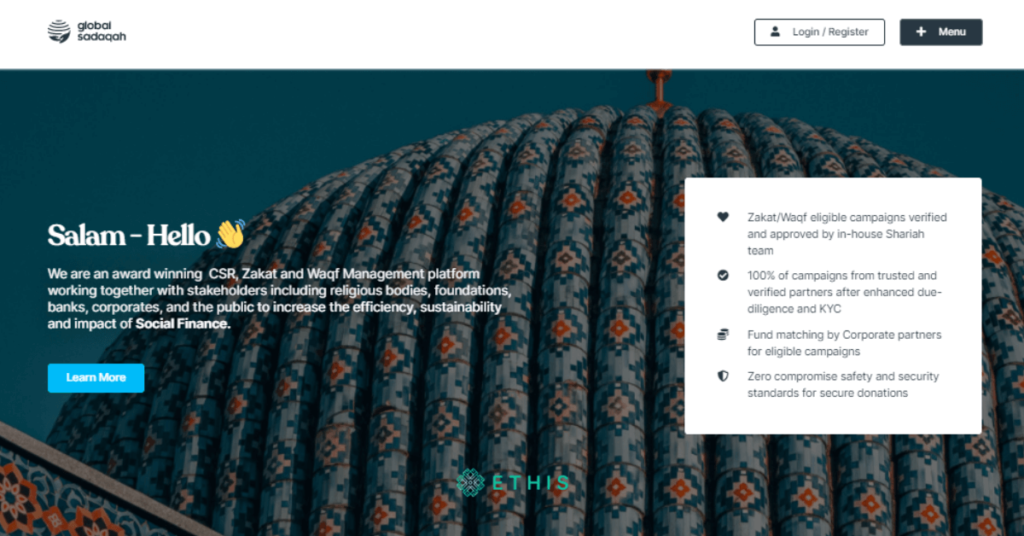

Blossom Finance helps institutions to raise cost-effective, Shariah-compliant financing from global investors using blockchain technology on its Smart Sukuk platform. Blossom was founded in 2014 to increase the availability of halal financial products using technology. Since 2015, Blossom has been helping microfinance institutions in Indonesia raise funds from international investors to fund micro-businesses aimed at reducing regional poverty. Global Sadaqah has also made use of payments via cryptocurrency.

Artificial Intelligence and Zakat

The functions performed by humans are being replaced by machines and artificial intelligence, as evident in the financial industry today. Another innovation we see is zakat chatbots powered with artificial intelligence technology replacing the officers who provide information about zakat and the calculation of it.

This could be described as an improvised version of the simple zakat calculators we use now. In this regard, in 2014, Afaf Al-Riyami, Asma Al-Harthy, Khadija Al-Amri and Kamla Ali Al-Busaidi from Sultan Qaboos University of Oman presented at the 15th European Conference on Knowledge Management, ECKM 2014 research on zakat expert system (ES). They say that ES is part of applied artificial intelligence and the idea of an ES is to convert knowledge from human expertise to a computerized system. The objective of their study is to apply expert system technology in the field of Zakat to assist Muslims in the decision making process including identifying the rules of making Zakat payments and assisting in complex calculations.

They state that the objective of the Zakat ES is to specifically help people calculate the amount of each type of Zakat they have to pay every year., the system helps users to:

(1) determine if they are required to give Zakat;

(2) determine the unique conditions, and the amount of each type of Zakat they have to pay every year. The system was developed based on a rules-based expert system shell. To develop such a system, information that is obtained from a human expert is represented in the form of rules, such as IF-THEN. Then the rules are used to perform operations that lead to achieving certain goals.

It is stated that after reviewing the Zakat expert system, the majority of the 20 potential users also indicated that the system saves time and effort in searching for information related to Zakat’s rules. Users also indicated that it is very useful for calculating Zakat quickly and accurately, and is very beneficial, convenient, and easy to use for people who have no knowledge about Zakat. Other strengths of the system are that it is more convenient than going to human experts and provides a variety of Zakat types.

Pahang Zakat Collection Center (PKZ) has also introduced a chatbot called ZakatChat. ZakatChat is an artificial intelligence based application provided by PKZ to smartphone users and visitors to PKZ’s official website to interact and help answer questions about zakat property. It is stated in their official website that ZakatChat uses a specially programmed search engine technology to match questions asked with available databases. In addition, ZakatChat also guides users to obtain additional information from other mediums if the information is not available in the ZakatChat database.

In 2018, in collaboration with PT Artina Digitama Indonusa (Artdigi), the National Amil Zakat Agency (Baznas) of Indonesia launched a Zakat Virtual Assistant Chatbot named “Zaki” for the first time in Indonesia. It was reported in a local newspaper of Indonesia, SWA that Zaki can be accessed on the LINE messenger application under the name @zakibaznas and in the near future it will be available on the Facebook Messenger chat application and the community can calculate the amount of zakat accurately, literacy, and zakat education as well as information on Baznas social and humanitarian programs. Zaki’s features that will be coming soon include maps of the nearest mosque location, prayer schedule reminders to da’wah material. With chatbot technology that is equipped with Natural Language Process, it allows this feature to be able to chat with users to analyze the wishes of the users.

Apart from the chatbot, BAZNAS has developed an internal platform, for donation services through the BAZNAS website (baznas.go.id/zakatsekarang) and through the Muzaki Corner application service and an external platform, where the platform comes from BAZNAS partners who provide special space and options for the community to zakat through BAZNAS. Some of the examples for this are the option of zakat and charity through kitabisa.com, gojek, bukalapak, tokopedia, and others.

Apart from this social media platform to facilitate direct donations through social media is made. The National Zakat Index (IZN) is also introduced to measure zakat. BAZNAS has also a plan to introduce an electronic commerce platform to increase market access for mustahik products benefiting the productive zakat program.

Big Data and Zakat

Zakat information or data management also face challenges as information on zakat including the payers, distributors, receivers and other stakeholders need to be maintained and the volume of this data is growing day by day. Big data can resolve this. Big data can be described as a technology that enables to analyze, systematically extract information from, or otherwise deal with data sets that are too large or complex to be dealt with by traditional data-processing application software.

In 2015, Hidayah Sulaiman, Zaihisma Che Cob and Nor’ashikin Ali presented a paper in the International Conference on Software Engineering and Computer Systems (ICSECS) about the Big data maturity model for Malaysian zakat institutions to embark on big data initiatives. They state that the main difficulty in handling large amounts of data is due to the five big data concepts involving volume, velocity, variety, veracity and value which increase rapidly in comparison to the computing resources, while zakat administrators are currently facing issues with the growing amount of data on zakat payers, zakat distribution and various zakat recipients.

They state that overwhelming amount of data must be carefully managed by the zakat institutions and the appointed zakat fund trustees as zakat data resides in massive, unstructured information, largely in various forms of numeric, text and imagery, there is a need for zakat institutions to switch to better data management mechanisms.

Their study proposes a big data maturity model to gauge the readiness of zakat institutions to embark into the big data evolution and the proposed model also provides the zakat institution with more structured processes of managing the high volume of data in order to provide better reporting transparency, making well-informed decisions and earning confidence and trust from the community on better zakat management and distribution.

Internet of Things (IOT) and Zakat

The Internet of things (IoT) is described as the network of physical objects—“things” or objects—that are embedded with sensors, software, and other technologies for the purpose of connecting and exchanging data with other devices and systems over the Internet. Today using IoT it is possible to measure the stress level and the poverty level of a household.

As such, there is no reason why zakat distribution to the poor can be enhanced via linking it with IoT. The advantage of this could be that the poor who register with zakat administration authorities will have to register a single time and via the data receive from the household, zakat administrator can determine whether the household is eligible to receive zakat and can actually deliver the zakat via a QR Code through the smart gadget with sensor connected to internet that collects the data from the household or by physical delivery of zakat to them by locating their geographical location through GPS tracking enabled feature that will be embedded in the smart gadget. Global Sadaqah has been working towards making the Zakat process hassle free.

Conclusion

From the above, it is evident that in this era of technology and with industry 4.0 or fourth industrial revolution, utilization of technology is unavoidable and the public interest or maslahah vests in the use of it in all aspects of our lives. Financial technology or finTech has not only changed banking, takaful and capital market industry; but the social finance industry has also been transformed by it. Global Sadaqah has been adopting the latest technology for making the process of giving out Zakat hassle free. The discussion in this article illustrates the integration of technology with zakat. In future it is anticipated that there will be ongoing initiatives to enhance zakat via technology.