The world is rapidly changing all around us. Markets are becoming extremely volatile and investors are looking for options to safeguard their money. The best option in a volatile market is generally to turn towards gold. Unlike a federal bank printing more currency notes or a company issuing more shares, gold is limited in supply and must be dug up from the ground and processed.

Gold usually performs well during dynamic or volatile shifts in the market. As an asset, it doesn’t necessarily rise fast, but rather, it remains static to a large degree while others decline and this is quite useful as a hedge. Plus, as more people turn away from stocks etc and invest in gold, the price rises accordingly.

Till now, gold has been a safe haven, but we have a new challenger to take the crown. In 2009, Bitcoin burst onto the scene and began a new era of digital currencies. Many have even called Bitcoin “digital gold”. For centuries people have placed their trust in gold. Gold also has a long history as a store of value that Bitcoin can’t match. Why? It was only a little over a decade ago that Bitcoin has come into the picture. In mid 2017, the price of 1 Bitcoin surpassed that of a single troy ounce of gold for the first time. This made a lot of people sit up and take notice of Bitcoin and the potential it had. Recently, JPMorgan published a global markets strategy note that points out money has flowed out of gold and into Bitcoin since October 2020, and predicts this trend will continue over the medium to longer term.

Mining and Numbers

Just like gold, even Bitcoin is limited in number. Satoshi Nakamoto, the pseudonymous creator of bitcoin, limited the total supply to 21 million tokens. One could even say that Bitcoin is much more limited if compared to gold as there is much more gold to be mined and we don’t have a fixed cap on that. Just like gold, Bitcoin is not issued by any central authority. So how do we “mine” Bitcoin? Bitcoin is generated by the collective computing power of “miners”. These are individuals and/or pools of people who are working in the network to verify transactions which take place on the Bitcoin network. These miners are then rewarded for their time, computing power, and effort with Bitcoins. To make sure that too many Bitcoins aren’t flooding into the market, the Bitcoin protocol stipulates that these Bitcoin rewards are periodically halved, ensuring that the final bitcoin won’t be issued until about the year 2140. Gold’s intrinsic value is technically on par with copper and aluminium. Gold’s scarcity is what makes it much more valuable than aluminium. People make jewellery with gold because gold is valuable. Gold is not valuable because people use it for jewellery. Bitcoin is digital scarcity – scarcer than gold.

Speaking about mining and gold, things could change soon with the fast paced development of tech and the power of AI led robotics. We don’t really know when all the world’s gold will be mined from the earth but we have companies that are looking into deep crust mining. There is also speculation that gold can be mined from asteroids, and there are some companies that are already looking to do this in the future. But that is not something practical as of now or even in the coming years. If the new technological advances in mining and extraction do work out, the prices of gold would drop sharply as the rarity factor would have also gone down.

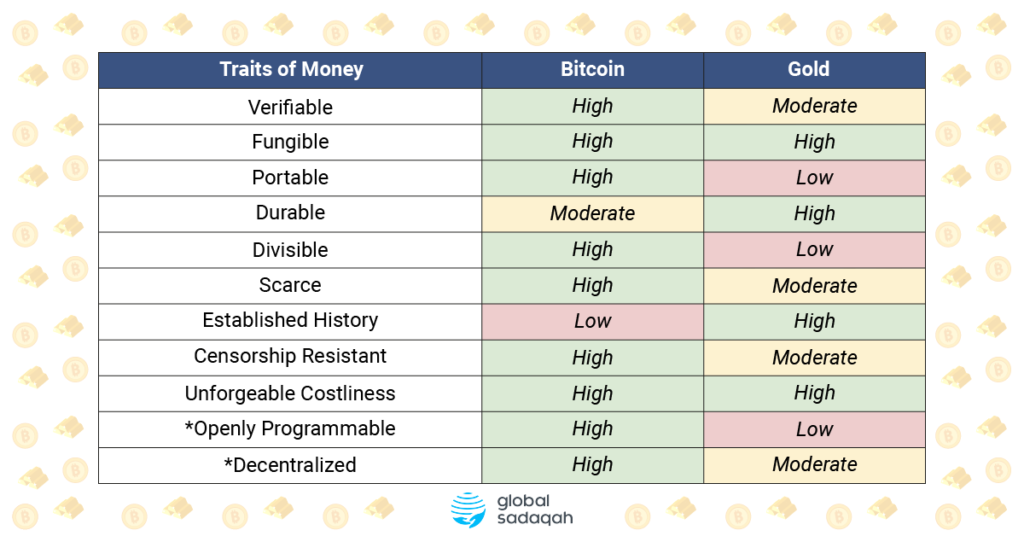

The Characteristics of Bitcoin & Gold

Gold is very hard to steal, corrupt, or fake gold. On the other hand it is tough to maintain, store, and transport. Bitcoin is very difficult to corrupt thanks to its encrypted, decentralized system and complicated algorithms built upon the blockchain. Even though the blockchain based network has not been hacked to date, the wallets that hold Bitcoin and related infrastructure have indeed been compromised. Bitcoin is much much more transparent as compared to gold. Every transaction can easily be traced and checked. Buying and selling gold on the other hand is much more difficult. Travelling with gold and customs checks where the gold has to be declared or has the potential to be ceased is another issue to navigate. Bitcoin is free from any such restrictions, regulations or potential dangers.

We have digital gold coming into the picture to tackle this issue, but even today, the vast majority of the world is involved in the physical buying and selling of gold. If we put both of them head to head, we see that gold leads over Bitcoin in the total amount of money held in the asset. Gold has a market cap of $9 trillion, while BTC has a market cap of $200 billion. In everything else, Bitcoin is the victor for scarcity, durability, portability, divisibility, storage and counterfeit difficulty. Bitcoin has also recently gained further notoriety as a store of value in the mainstream public eye in 2020, as multiple mainstream giants have invested heavily into the asset.

The biggest downside of Bitcoin has been the issue of its volatility. Extremely volatile in reality. Besides that, it is also seen that it is heavily subject to market whims and news. This can be seen recently when Elon Musk and Tesla pumped in 1.5 billion dollars into Bitcoin and the prices soared. As of February 2020, we see that the price of Bitcoin has crossed $40,000 per coin, exceeding parity with gold.

This is where stable-coins come into the picture which are either backed by fiat currency or gold. One such example is Tether. Tether is backed by the U.S. dollar just as gold was linked to the U.S dollar prior to the 1970s. Why are stablecoins so stable? The price of stablecoins remains stable because of collateralization or in simple terms, backing. It can also be because of algorithmic mechanisms where the asset in question is bought and sold.

Gold Backed Cryptos?

This seems to be like a brilliant mix where one gets the best of both worlds. Digital currencies backed by gold are growing in numbers which promise easier trading than physical gold. A major attraction for investors is that these gold-backed digital coins promise much easier ownership and trading than actual gold bars, which are bulky and require secure storage either by the investors or by custodian institutions.

In gold-backed digital currencies, the coin or token is backed with a dedicated or a specific quantity of gold. 1 coin could be backed by 1 gram of gold for instance. Even when it comes to gold, just like fiat currency, it needs to be held or stored in reserves, and generally this is undertaken by a third party.The biggest advantage here is that unlike fiat backed stable-coins, gold backed coins’ minimum value will always be equal to the fixed amount of gold. Holding digital gold in itself has become quite easy nowadays.Linking that digital gold to cryptocurrencies could be something we could be looking at very soon.

Global Sadaqah is one of the first platforms in the industry that accepts donations in digital gold as well as Bitcoin. They even facilitate Zakat on cryptocurrencies.

Does this mean that the era of gold investment is coming to an end? Not really. Even though the upcoming tech savvy generation wants to invest more in cryptocurrencies rather than gold, gold’s role as a store of value is well entrenched in investment lore, and even forward-thinking and open-minded investors and advisers recommend that Bitcoin at least for now will complement the precious metal rather than replace it. This isn’t an article that talks about how and what to invest in, it is a discussion that brings to light a raging debate. Let us know in the comments what’s your take on the matter. My take: Etch your private keys onto a bar of gold. Happy donating and investing.